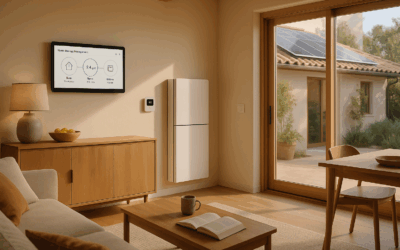

ERIA has traveled to the heart of innovation in Silicon Valley on a stay organized by ACCIÓ, as part of an itinerary for Catalan corporations with a focus on AI and open innovation.

We visited, among others, the Google headquarters, Plug and Play Tech Center and Hilti headquarters, where we met with Hilti Ventures to deepen the company-startup collaboration. We also attended the TechCrunch Disrupt fair, focused this year on agent-based AI and where we were able to be present at the pitch of several Catalan startups. In addition, we held a session with Carlos Escapa (AWS) on how the innovative culture is managed within AWS and the prospects for deploying AI at scale —with attention to the European energy context—, and we talked with entrepreneur Michael Burtov about the convenience of many startups prioritizing alternative financing channels to VC by forging alliances with corporations to test and integrate products. Finally, we participated in networking at Mind the Bridge, a key meeting point between startups and corporations.

Beyond the technological immersion, the stay has allowed us to understand how corporations and startups collaborate with impact in the midst of the AI explosion, without losing strategic coherence. Below, we share the 6 lessons we took away from ERIA.

1. AI as an engine of change

In Silicon Valley, AI is at the center of everything. The most notable difference lies in how companies integrate AI directly into the core of their business models.

- Leading corporations no longer consider AI as an isolated project: they see it as a cross-cutting element that improves automation, data-driven decision-making, generative design, and personalization.

- Investment funds, such as Cathay Innovation, are committed to specific sectoral solutions (health, energy, mobility, consumption), where AI solves real problems and generates tangible value.

- In Europe, technology is not as lagging behind as in the US or China, but access to energy and network infrastructure can limit large-scale implementation, especially for projects that require a lot of computing.

Specifically, and with regard to the energy sector, we saw AI applied to the entire value chain: from the design of renewable assets and parks with generative models, to demand management and dynamic tariffs in smart buildings, through price prediction and the detection of anomalies in transmission and distribution.

2. CVC evolves: beyond financial return

Corporate Venture Capital (CVC) units seek, in addition to economic profitability, to create a direct impact on the core business, providing new capabilities, technology and access to innovative markets.

Some key practices we observed:

- Integration with business units: having executive sponsors and shared goals from day one ensures that investments bring real value. Paid pilot as a customer (“venture customer”): before investing, testing the technology with defined success criteria and KPIs reduces risk and allows for data-driven decisions.

- Combination of commercial operation and investment: if the pilot works, it can be scaled up with a contract and then invested in the startup, guaranteeing strategic fit.

- Governance and speed: Having lightweight processes, secure sandboxes, and pre-agreed legal templates accelerates time to first value.

In short, the most effective CVC acts as a business accelerator, not as a parallel portfolio of holdings.

3. Corporation–startup bridges: transforming connections into results

The experience at Silicon Foundry and Plug and Play confirmed that open innovation works best when there are intermediaries who translate between the language of corporations and startups. This reduces cultural (speed vs. governance), time (weeks vs. months) and risk (experimentation vs. regulatory compliance) frictions, and allows matchmaking to evolve into pilots and, if appropriate, contracts or investments.

At ERIA, our role is exactly this: connecting startups with Estabanell’s business units, with acceleration and venture client programs that validate value propositions in 8–10 weeks and prepare them for scalability.

4. Culture is strategy: learn quickly and focus on the customer

In Silicon Valley, we saw that the big differentiator is not just technology, but culture. Integrating innovation into the evaluation and incentives of key roles helps to solidify that culture.

At Amazon, three operating principles stand out: obsession with the customer, bias for action (fast testing with controlled risk) and disagree & commit (intense debate, commitment once decided). At Google, user orientation is combined with psychological safety and data-driven decisions, which allow iterating without losing quality. And at Stanford’s d.school, “fail forward” is practical: prototype quickly and cheaply, test with real people and iterate by turning errors into actionable information.

5. Rethinking financing: diversifying beyond VC

According to Michael Burtov, an expert in innovation and startup financing and author of The Evergreen Startup, venture capital is not the only way to finance startups. A combination of venture capital, equity crowdfunding, angel investors and other alternatives allows for risk diversification and democratization of access to capital.

In his opinion, for corporations, the best strategy is to act first as an indirect funder: offering paid pilots, market access and data to validate products, before making direct investments. This approach (venture client) accelerates the time to first value, reduces risk and prevents promising projects from getting trapped in the gray area of “phantom startups” (progress without sufficient return for investors).

6. Innovation ecosystems: quality before quantity

Silicon Valley’s success comes from the quality of connections, the speed of learning and the coherence between research, capital and market. In Europe, we can build intense ecosystems without sacrificing values such as work-life balance or sustainability. This means fostering collaboration between actors, committing to patient financing, linking innovations to real challenges and establishing agile processes so that pilots with startups can be executed and scaled quickly.

Conclusion: Transforming learning into action

The mission to Silicon Valley confirms that innovation is a cultural process, not a one-time event. The lessons for ERIA and Estabanell are clear: put the customer at the center, integrate AI as a strategic enabler, foster a culture that learns quickly from mistakes, and collaborate intelligently with the startup ecosystem in search of strategic value and measurable results. With this approach, innovation is transformed into concrete actions that generate real and sustainable impact.